Magellan Financial Group (ASX: $MFG) resolves legacy issues and reports 1H24 overview

- Author: Stock Piper

Magellan Financial Group (ASX: $MFG) 1H24 Overview

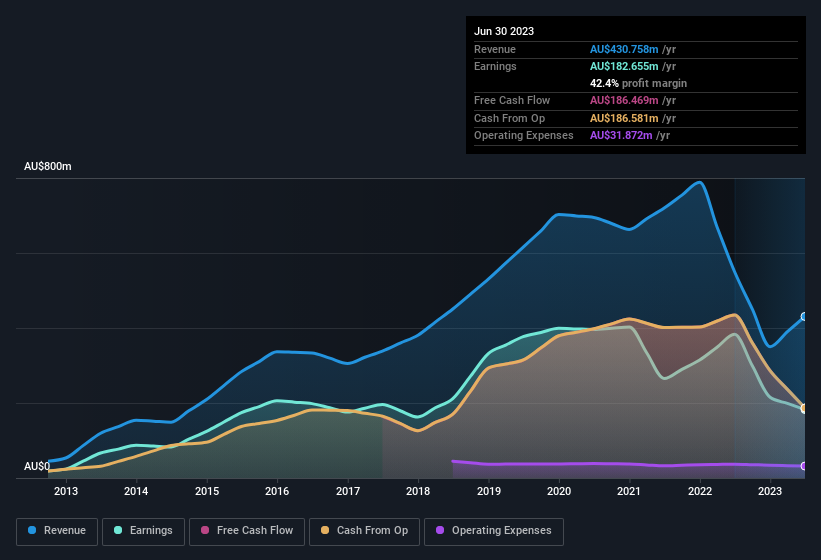

Magellan Financial Group Limited (ASX: $MFG) has addressed outstanding Employee Share Purchase Plan (ESPP) loans for current employees and resolved uncertainty on Magellan Global Fund (Closed Class) (MGF). The company reported Funds Under Management (FUM) of A$36.3 billion as at 31 January 2024, with signs of continued improvement in investment performance in Global Equities and Infrastructure, and Airlie continuing strong outperformance. The Group achieved an adjusted 1H24 net profit after tax of $93.5 million and declared an interim dividend of 29.4cps.

Executive Commentary on 1H24 Overview

Andrew Formica, Executive Chairman, stated that the company has successfully resolved legacy issues, restored corporate stability, and achieved a profitable 1H24. The company continues to assess strategic growth opportunities that are accretive to the business. The Funds Management segment represents the core business driving profits and dividends, with a cost to income ratio of 39.1% and operating expenses tracking in line with full year cost guidance. The company's strong balance sheet provides strategic flexibility and optionality, supporting organic and inorganic growth.

Summary of 1H24 Performance and Outlook

Magellan Financial Group has demonstrated a proactive approach in resolving legacy issues and achieving corporate stability. The company's focus on addressing outstanding ESPP loans and uncertainty on MGF reflects a commitment to enhancing employee welfare and investor confidence. With a strong balance sheet and profitable performance, Magellan is well-positioned for organic and inorganic growth. The company's continued assessment of strategic growth opportunities and the successful resolution of legacy issues indicate a positive outlook for its corporate strategy.