oOh!media (ASX: $OML) reports 7% revenue growth and a 10% npat increase

- Author: Stock Piper

oOh!media Limited (ASX: $OML) Financial Results for CY23

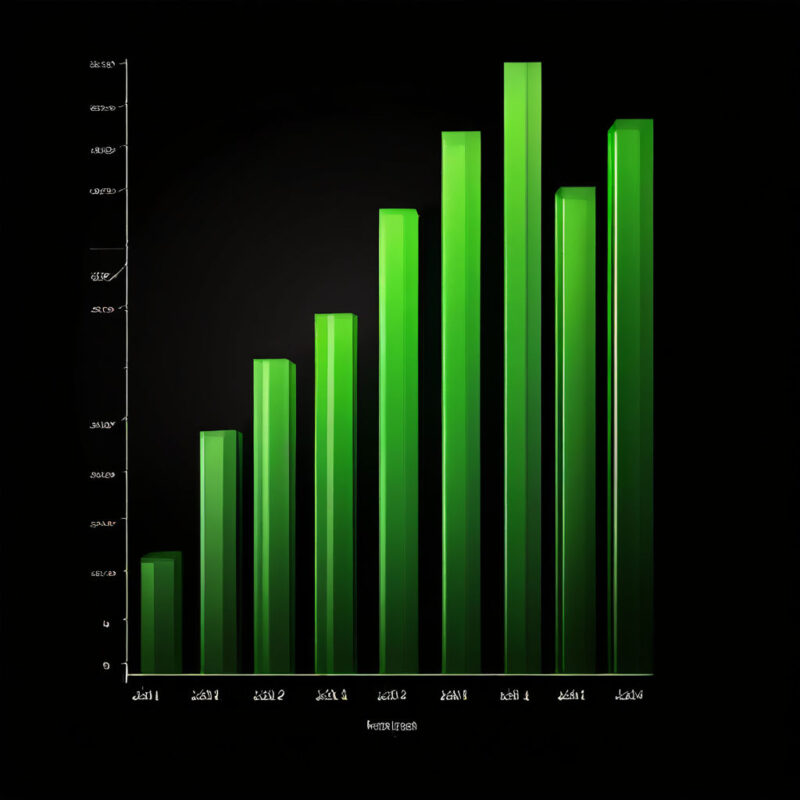

oOh!media Limited (ASX: $OML) has reported a 7% revenue growth and a 10% increase in statutory net profit after tax (NPAT) to $34.6 million for the year ended 31 December 2023. The company's disciplined approach to contract renewals has resulted in the successful retention of 75% of large contracts expiring in 2023. Additionally, new contracts are expected to deliver $30 million in annualized revenue upside from mid-2024. The company's new retail media offering, reooh, has secured long term contracts with two customers and a pilot program with a major Australasian retailer. The fully franked full year dividend has increased by 17% to 5.25 cents per share.

Executive Commentary on Financial Results and Outlook

We delivered a solid result which highlights the financial discipline and operational improvements that are positioning oOh! to capitalize on the continued growth of Out of Home which remains the fastest growing media segment. The Group is developing innovative new revenue streams while remaining disciplined on our approach to renewing existing contracts or winning new contracts. This is expected to strongly position oOh! to retain market leadership and build revenue in a rapidly evolving sector. Our focus remains on leveraging the structural growth opportunities in Out of Home to build profitable market share, while also diversifying into new adjacent revenue streams to deliver long-term sustainable earnings growth.

Summary of Financial Results and Outlook for CY24

oOh!media Limited (ASX: $OML) has reported a 7% revenue growth and a 10% increase in statutory net profit after tax (NPAT) to $34.6 million for the year ended 31 December 2023. The company's disciplined approach to contract renewals has resulted in the successful retention of 75% of large contracts expiring in 2023, without margin degradation. Additionally, new contracts are expected to deliver $30 million in annualized revenue upside from mid-2024. The company's new retail media offering, reooh, has secured long term contracts with two customers and a pilot program with a major Australasian retailer. The fully franked full year dividend has increased by 17% to 5.25 cents per share. Looking ahead to CY24, oOh! expects mid to high single digit revenue growth for the industry and anticipates a flat outcome to the prior corresponding period (pcp) for Q1 media revenue pacing, with improved momentum over recent weeks. The company's adjusted gross margin in CY24 is expected to be in line with CY23, while remaining disciplined on operating expenditure with a focus on reinvesting into the business to capture future revenue growth. Capital expenditure for CY24 is expected to be between $45 million and $55 million, subject to development approvals, focused on revenue growth opportunities and concession renewals.