New Hope Corporation (ASX: $NHC) reports 62% decrease in net profit for H1 2024

- Author: Stock Piper

New Hope Corporation (ASX: $NHC) reports significant decrease in financial performance for H1 2024

New Hope Corporation Limited (ASX: $NHC) has reported its financial results for the half-year ended 31 January 2024. The company's net profit after tax (NPAT) decreased by 62% to $251.7 million compared to the same period last year. The underlying earnings before interest, tax, depreciation, and amortization (EBITDA) also saw a significant decrease of 59% to $424.8 million.

Executive Commentary on Financial Performance for H1 2024

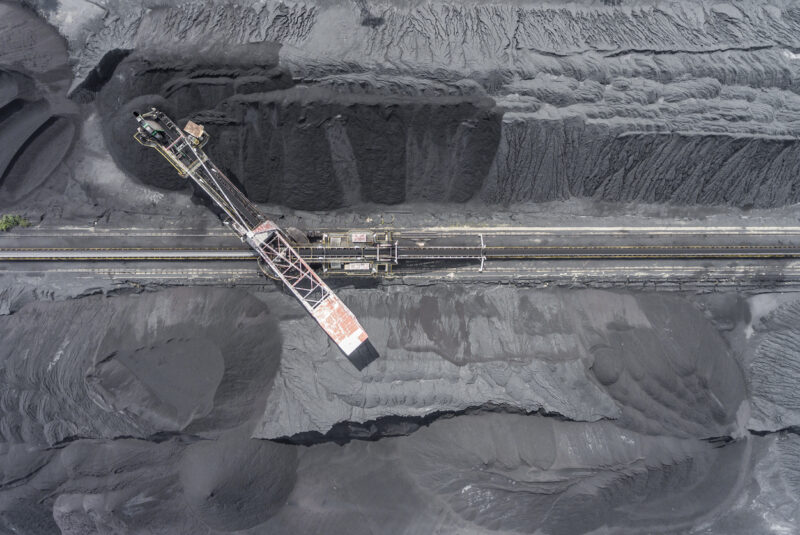

The Directors present their report on the consolidated entity consisting of New Hope Corporation Limited and its controlled entities. The company's financial performance for the half-year ended 31 January 2024 has been impacted by various factors including a 58% decrease in the realized price of coal, a 23% decrease in taxes paid, and a 37% increase in the workforce. The decrease in net profit after tax reflects the challenges faced by the company in the current market conditions.

Outlook and Corporate Strategy for New Hope Corporation

New Hope Corporation remains committed to safely and responsibly operating its low-cost, long-life assets throughout the energy transition. The company aims to focus on providing valuable returns to its shareholders and is optimistic about the outlook for high-quality, low-emission thermal coal. Additionally, the company is exploring opportunities to maximize shareholder value outside of its coal portfolio and is on track to double saleable production within the next five years with moderate capital investment.