Elders (ASX: $ELD) showcases resilience amidst challenging conditions

- Author: Stock Piper

Elders FY24 financial results overview

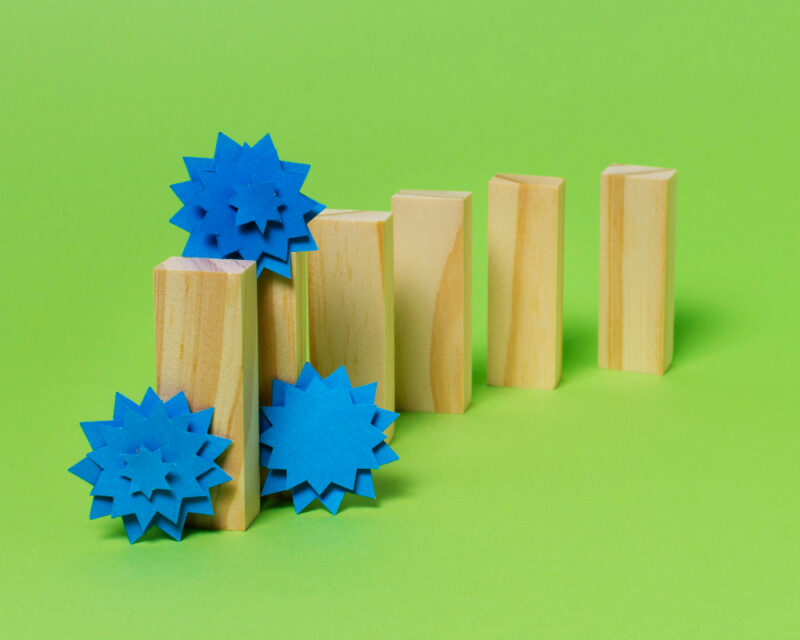

Elders (ASX:ELD), a prominent Australian agribusiness, has unveiled its financial results for the fiscal year ending September 30, 2024. The company demonstrated resilience in the face of challenging seasonal conditions and market volatility. Key financial metrics included an underlying EBIT of $128 million, reflecting a 25% year-on-year decline. Elders maintained a strong balance sheet while focusing on operational efficiencies and strategic growth initiatives.

Elders' strategic outlook and future prospects

Elders reported a sales revenue of $3.13 billion, a 6% decline compared to the previous year, with an underlying net profit after tax of $64 million, marking a 38% decrease. Despite these declines, the gross margin improved to 20.4%, and the company maintained a robust approach to navigating market volatility. Elders completed 13 acquisitions during FY24, enhancing its presence across Australia. The company is committed to sustainability, targeting significant emission reductions by 2030. Elders' Eight Point Plan aims for consistent EBIT and EPS growth, emphasizing optimizing existing operations and expanding products and services. Looking ahead, Elders anticipates a return to average seasonal conditions, expecting a more favorable operating environment in FY25, bolstered by a recovery in livestock prices and improved market sentiment.

Executive insights on Elders' performance

Elders continued its expansion with 13 acquisitions completed in FY24, significantly increasing its points of presence across Australia. The company is investing in systems modernization and transformational projects to improve operational efficiency and customer experience. Elders maintained a strong focus on safety, health, and sustainability, with a target to achieve significant emission reductions by 2030.