Black Dragon Gold Corp. (ASX: $BDG) divests Padbury Gold assets

- Author: Stock Piper

Black Dragon Gold Corp. (ASX: $BDG) reports financial results for the three months ended March 31, 2024

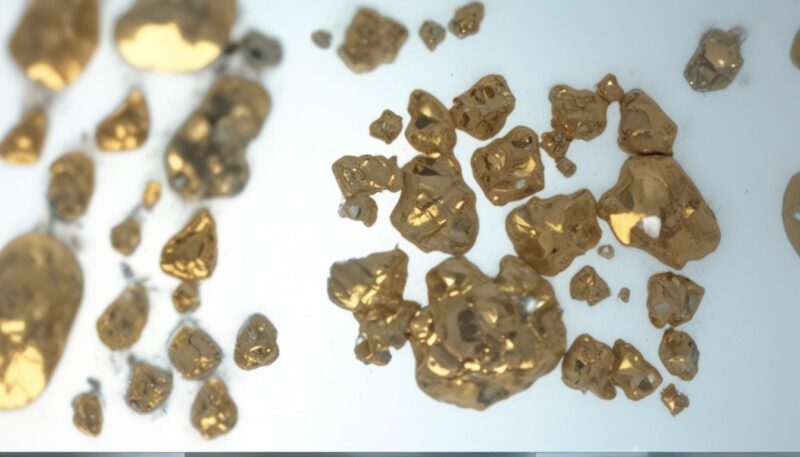

Black Dragon Gold Corp. (ASX: $BDG) has reported a comprehensive loss of $220,866 for the three months ended March 31, 2024, a reduction from the previous year's loss of $381,552. The net cash used in operating activities during the same period was $257,505, down from $303,511 in the corresponding period of the previous year. The Company continues to focus on developing the 100% owned Salave project in Northern Spain and has divested 100% of its Padbury Gold assets for a cash consideration of AUD$150,000.

Executive Commentary on Company's Progress and Financial Position

The Company's management is actively targeting sources of additional financing through alliances with financial, exploration, and mining entities, or other business and financial transactions to ensure the continuation of the Company's operations and exploration programs. The divestment of Padbury Gold assets is part of the Company's strategic approach to maintain adequate levels of funding to support the development of its business and maintain necessary corporate and administrative functions. The Company's unaudited condensed consolidated interim financial statements for the three months ended March 31, 2024, do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence.

Summary of Black Dragon Gold Corp.'s Corporate Strategy and Outlook

Black Dragon Gold Corp. (ASX: $BDG) continues to focus on developing the 100% owned Salave project, one of the largest undeveloped gold projects in Europe. The Company is actively seeking additional financing to ensure the continuation of its operations and exploration programs. The divestment of Padbury Gold assets is part of the Company's strategic approach to maintain adequate levels of funding to support the development of its business and maintain necessary corporate and administrative functions. The Company's management is actively targeting sources of additional financing through alliances with financial, exploration, and mining entities, or other business and financial transactions. The Company's ability to continue as a going concern depends upon its ability to develop profitable operations and to continue to raise adequate financing. The Company invests all capital that is surplus to its immediate operational needs in short-term, high liquid, high-grade financial instruments. The Company will need to raise additional capital by obtaining equity financing, selling assets, and incurring debt to develop its business.