Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.71%

Gold

2,673.70

0.76%

Copper

4.12

(0.88%)

Oil

69.81

1.12%

Bitcoin

98,153.58

4.03%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,932.29

0.9%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.15%

Hang Seng

19,601.11

(0.23%)

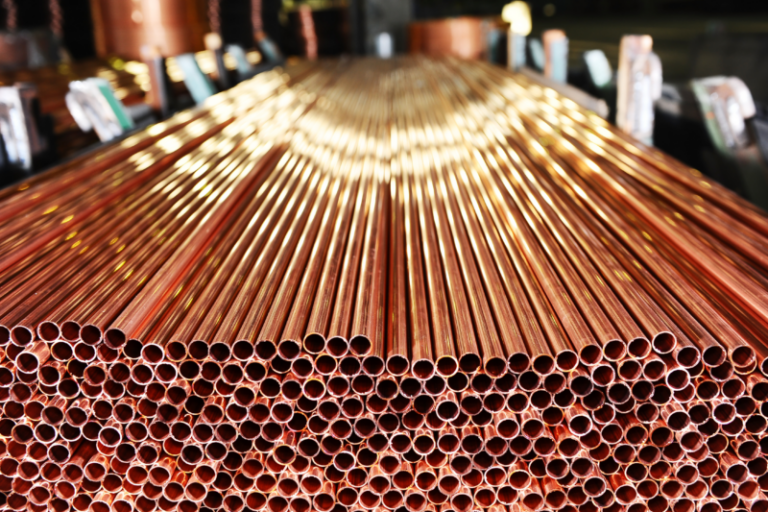

Cobre Ltd Poised to Benefit from Global Rally in Copper Prices

- Author: Stock Piper

Key Takeaways

- Strong copper demand and supply issues are fuelling a rally

- Copper is vital for the energy transition and Cobre has important deposits

- Cobre Limited (ASX: $CBE) has discovered major mineral deposits that will support the supply demand

- Strong technical know-how to support cost-effective exploration

- The rally in global copper prices will support Cobre’s share price over the medium term.

Shortage in Global Copper Supply

Copper prices are rallying, driven by the tightening of supply in global mine supply. The closure of the giant mine in Panama last year and worries about Zambian copper output due to the El Niño-induced power crisis. Continued global demand for copper and shortages suggest that explorers and producers are set to perform well in such an environment. In this article, we look at one underrated stock in the Australian Stock Exchange that is set to benefit from higher copper prices and the energy transition. While the stock has been struggling for upward momentum, it appears that it may be nearing an inflection point.The Supply Issues and Possible Shortages are Fuelling a Rally

Copper rose by 2% to $9,066.50 a ton on the London Metal Exchange on Friday 15 March 2024 even as other metals were mixed, with aluminium gaining 0.6% and lead dropping 1.8%. Copper prices surged by 5% in the week ending 15 March 2024. This ended a months-long spell of range trading or inertia as investors worried about supply. Meanwhile, traders are equally warming to the idea that the worst for copper demand may have passed and a global downturn linked to electric vehicle sales may be ebbing off.Copper is Vital for the Energy Transition

Copper is fundamental to renewable energy infrastructure, storage systems, and electric vehicles (EVs). Fast rates of urbanisation require more infrastructure, which increases demand for copper as it is a highly efficient conduit for renewable energy systems needed to generate power from solar, hydro, thermal, and wind energy across the world. In 2022, copper demand from China, the European Union, and the United Kingdom reached 10.8 million metric tons. In 2024, analysts forecast copper demand could rise to 28 million metric tons, which will drive the rally in prices and support mining stocks across the world.Cobre has Discovered Major Mineral Deposits that will Support the Supply

Cobre Limited (ASX: $CBE) is exploring a copper prospect in the Kalahari Copper belt and has signed an agreement giving it 100% in licences for investment and exploration. Cobre’s four projects include the KCB: Okavango (2,720 km squared), Kitalnya East (2,650 km squared), Ngami (720 km squared) and Kitalnya West (2,900 km squared). All four are close to major discoveries and will enable Cobre to serve both African, European, and Asian customers effectively. This is relevant at a time when major producers in Zambia are facing supply constraints.

Cobre Limited (ASX: $CBE) Shows Positive Momentum

Cobre Limited (ASX: $CBE) is looking promising on the weekly chart, with indications suggesting it's on the verge of a significant breakout. It's consistently holding above its 20-week moving average, signalling strong potential for an upward surge. Cobre is an emerging resources exploration growth company with prospective projects in both Botswana and Western Australia, Cobre’s enriched high-grade copper discoveries and high-grade development pipeline seeks to underpin copper’s future growth in the electric vehicle and renewable energy sectors.Discovery of Copper Deposits and Strong technical know-how will support Cobre Exploration

Cobre equally has the right technical capacity to execute projects with strong medium to long-term potential. Executive Chairman Martin Holland recently announced the discovery of a VHMS deposit within its Perrinvale Project area in the Panhandle Greenstone Belt of Western Australia. Discovering a high-grade VHMS system enriched in copper, gold, silver, and zinc from our maiden drill program is a credit to our technical & exploration teams. Its technical capacity and strategically located projects in countries like Botswana with a supportive environment for foreign firms illustrate long-term strategic thinking. Furthermore, it has partnered with several companies to ensure that new sites are adequately explored and uses new technology to minimise environmental damage. This suggests that Cobre should already be outperforming its peers, but while the stock has traded sideways recently, there is strong reason to believe that it has reached an inflection point. Cobre Limited (ASX: $CBE) presents an intriguing observation on the weekly chart. Initially, the ten-week simple moving average served as resistance, but it's now functioning as reliable support, indicating a potential shift in sentiment.

With that being said, there are three reasons you should consider buying Cobre Ltd:

- Cobre is focused on minerals that will be used for the energy transition: Cobre Ltd. is focused on the exploration and discovery of copper and new high-grade base metal deposits in Botswana and Western Australia. Cobre Limited is a pure-play copper explorer across two Tier-1 mining jurisdictions, Australia and Botswana, and has discovered a VMS deposit enriched in high-grade copper, gold, silver, and zinc within its Perrinvale Project area in the Panhandle Greenstone Belt of Western Australia.

- Strong technical know-how in finding and exploiting projects: The Cobre team has over 50 years of mining experience in Africa, Europe, and the Middle East. Their strong background has caused them to apply an innovative and cost-effective approach to exploration that minimises waste and land pollution. Cobre prioritises responsible exploration practices, minimising environmental impact, and fostering positive relationships with local

- Cost-sensitive approach to exploration: Cobre’s approach to partnerships will reduce costs over the long run and improve revenues. This approach will protect shareholder value and lead to better returns in the long run. For example, Cobre Ltd has partnerships with BHP reflecting a shared vision of uncovering new critical mineral deposits essential for the global energy transition. This underscores BHP's confidence in Cobre's potential to unearth significant copper-silver deposits.

ASX News, First

& Fast.

By clicking Subscribe, you agree to our Terms & Conditions

ASX News, First And Fast.

By clicking Subscribe, you agree to our Terms & Conditions

Support

© 2024 Stock Piper. All rights reserved

Social Media Auto Publish Powered By : XYZScripts.com

Stock Piper AI Index Coming Soon!

Join our Newsletter to gain exclusive insight and be notified once we are live.

By clicking Subscribe, you agree to our Terms & Conditions

ASX News, First And Fast.

Get all the latest market updates straight to your inbox.

By clicking Subscribe, you agree to our Terms & Conditions

CBE and BHP all rallied on the news of higher copper prices. But I think they’re more likley to benefit from copper demand over the long run due to their strategic choices of tenements in Botswana.