Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Lithium

45.62

0.7%

Gold

2,675.40

0.83%

Copper

4.12

(0.67%)

Oil

69.90

1.25%

Bitcoin

98,266.37

4.15%

FTSE 100

8,149.27

0.79%

Nikkei 225

38,026.17

(0.85%)

Dow Jones

43,994.79

1.05%

Iron Ore

102.15

1.11%

USD/AUD

0.65

0.14%

Hang Seng

19,601.11

(0.23%)

Copper Shortage and Strong Fundamentals to Boost Cobre Share Price

- Author: Stock Piper

Copper prices have rallied in Recent Weeks

Copper Prices have risen in recent weeks, reaching $9,356 per metric ton on January 23 due to supply shortages and rising demand expected in China. Following strict COVID-19 lockdowns, the top consumer of copper is now expected to increase demand for copper, driven by EV sales and its transition towards a more sustainable economy. If one takes a longer look at the development in copper prices from 2020, they have risen by about 125% and are among the commodities that have reached record highs since the pandemic began. Several factors have contributed to the rally in copper prices, which will be analysed below.Supply could slow due to protests in Chile’s largest Mine

Over the past three decades mining output for copper has grown far more slowly than other metals, hitting 123% while aluminum production grew by 256% and iron ore rose by 257%. Meanwhile, the closure of the Chile Escondida mine has equally caused supply worries to mount, causing prices to rally. Meanwhile, the Las Bambas copper mine is forced due to protests from mine workers, which will equally cause scarcity to rise. However, there are strong reasons to believe that Cobre Ltd will see strong gains as copper prices remain elevated. The literature finds that mining stocks correlate strongly with copper prices, while this is especially the case for larger producers, this holds for efficient small-scale producers like Cobre Ltd and Fuse Minerals.The Transition to Renewable Energy will increase the demand for Copper

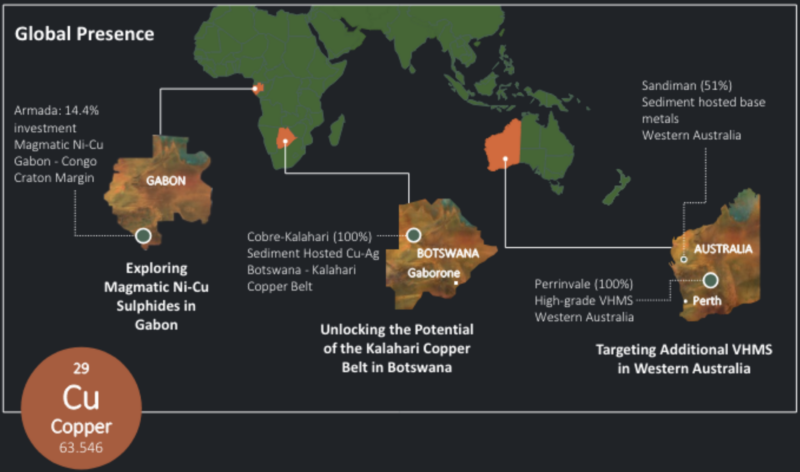

Electric vehicles (EVs) require four times more copper than internal combustion engine cars, according to the International Copper Study Group. It can be found in batteries, windings, rotors, wiring, busbars, and charging infrastructure. The transition towards EVs is already becoming evident in transportation. In 2021, sales of EV vehicles surged by 160% to 2.6 million vehicles even as EVs account for less than 4% of global sales. If EV sales continue to grow at a fast pace, the share relative to combustion engine-powered cars will rise. This will support demand for copper and other metals. It is important to note that the cost of EVs has been falling rapidly, which will make them less expensive than vehicles that are powered by combustion engines over the coming years. Among world economies, the fastest growth in EV demand is in China, where EV sales rose by 190% last year. Even outside China, copper demand has become the single most important source of copper demand for car manufacturers.Botswana- Kalahari Belt to Support High-Grade Copper Production at Cobre

- The KCB is regarded as one of the world’s most prospective areas for yet-to-be-discovered sediment-hosted copper deposits by the US Geological Survey and is emerging as a new copper production belt

- Botswana ranks in the top 10 countries globally for mining investment attractiveness by Fraser Institute 2022.

- Advances in geological understanding and geophysical technology have yielded an exponential increase in exploration success.

- Giant Deposits – 1/3 of known sediment-hosted copper deposits contain 500,000t of contained copper with grades >1%

- Excellent infrastructure, well-developed road networks, and ongoing multi-million-dollar projects, including the North-west Transmission Grid Connection (NWTGC) aimed at providing power supply to new KCB mines

- 100%-ownership of highly prospective copper and silver exploration tenements in the Kalahari Copper Belt (KCB).1

- • Second largest tenement package in the KCB consisting of four Project Areas: Ngami Copper Project (727 km2 ), Kitlanya East (1,359 km2 ), Kitlanya West (1,900 km2 ) and Okavango (1,362 km2).

- Along strike, and adjacent to, producing mining operations: Cupric Canyon’s high-grade Zone 5 Cu-Ag deposit and Sandfire’s (ASX: SFR) T3 Motheo Cu-Ag Production Hub.

Experienced Management Team will Support Production

Cobre’s management team cumulatively has over a century of experience between Martin Holland the Executive Chairman, Adam Wooldridge the Chief Executive Chairman (CEO), and Andrew Sissian (Non-Executive Director). Mr.Holland has raised $200 million and counting for exploration, focusing on new future metals discoveries, and is the founder and former CEO of Lithium Power. Meanwhile, the CEO, Mr. Adam Wooldrigge, is the founding partner and CEO of KML, developing the company’s exploration prospects over the last five years. He has over 25 years worth of experience in Africa, the Middle East, and Europe on large-scale multidisciplinary target generation. Other competent staff include Cobre possesses a strategic global landscape of potential copper opportunities, which have allowed it to accelerate development potential in Botswana via the Ngami Copper Project, and Kitlanya West Projects present discovery and potential copper development opportunities. Meanwhile, the in-situ copper discovery suggests the potential to upgrade major deposits, and its Tier-1 mining jurisdiction - Botswana - is ranked top ten in global mining investment attractiveness. Well-funded with approximately A$5.8 million in cash reserves, experienced leadership, and strong fundamentals as well as an experienced board and management team, along with a discovery-focused technical team based in Africa will support production and Cobre competitiveness over the long run. High copper prices will support margins and enable Cobre to position itself as an important supplier in the global marketplace.ASX News, First

& Fast.

By clicking Subscribe, you agree to our Terms & Conditions

ASX News, First And Fast.

By clicking Subscribe, you agree to our Terms & Conditions

Support

© 2024 Stock Piper. All rights reserved

Social Media Auto Publish Powered By : XYZScripts.com

Stock Piper AI Index Coming Soon!

Join our Newsletter to gain exclusive insight and be notified once we are live.

By clicking Subscribe, you agree to our Terms & Conditions

ASX News, First And Fast.

Get all the latest market updates straight to your inbox.

By clicking Subscribe, you agree to our Terms & Conditions

Good article but I think we should not forget good fundamentals. Innovative methods and choice of jurisdiction will boost the share price over the long run.