DXN (ASX: $DXN) reports 53% increase in gross profit for H1FY24

- Author: Stock Piper

DXN Limited's H1FY24 financial report highlights positive results

DXN Limited (ASX: $DXN) has reported a 53% increase in gross profit to $2,996,490 for the half-year ended 31 December 2023, reflecting a significant improvement in the company's performance. The group's revenues also saw a notable 19.0% increase, while the loss for the group after providing for income tax reduced to $838,392 from $2,241,444 in the previous corresponding period. The company's EBITDA for the reporting period is noted at $723,469, with underlying EBITDA at $802,044 after add back of non-cash, one-off non-operating items, and restructure costs. DXN's financial statements were subject to a review by the auditors, and the review report includes a paragraph addressing a material uncertainty related to going concern.

Executive commentary on H1FY24 performance and strategic initiatives

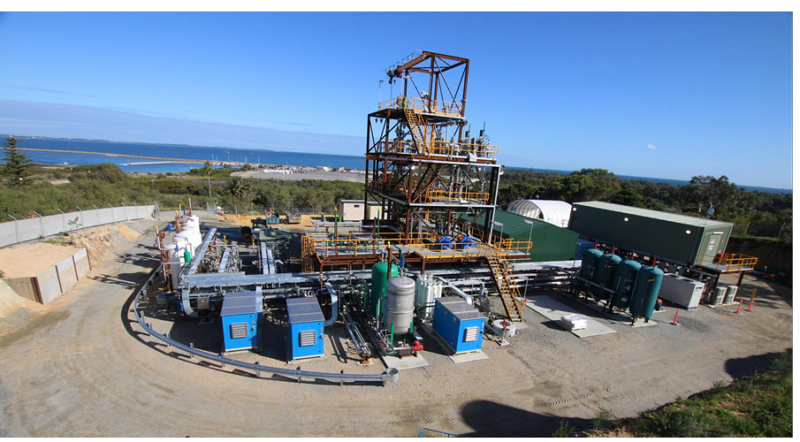

The company's H1FY24 results demonstrate the positive impact of the restructure initiated in FY23. We are pleased to see the significant improvement in our performance, with a notable increase in gross profit and a reduction in the loss for the group. Our continued momentum in modular manufacturing sales, including the execution of contracts for cable landing stations and modular data centers, reflects the success of our cost reduction initiatives and optimization efforts. The exit from the Sydney data center lease and ongoing cost savings initiatives have further strengthened our financial position. We are confident in the growth potential of our data center manufacturing and operations divisions, supported by the continuous investment in subsea cables and the increasing demand for prefabricated modular data centers. The successful equity placements and ongoing revenue generation from new contracts position us well for future growth and sustainability.

Outlook and future prospects for DXN Limited

DXN Limited's H1FY24 financial report reflects a positive trajectory for the company, driven by the restructure efforts initiated in FY23. The increase in gross profit, reduction in loss, and successful equity placements indicate a strengthened financial position and a promising outlook for future growth. The company's focus on modular manufacturing sales, including contracts for cable landing stations and data centers, aligns with the growing demand for data center solutions globally. The exit from the Sydney data center lease and ongoing cost savings initiatives have further enhanced the company's financial stability. With a developing pipeline of contracts and a strong support base, DXN is well-positioned to capitalize on the opportunities in the data center market and drive sustainable growth in the coming periods.