Gentrack (ASX: $GTK) delivers strong revenue growth in H1'24

- Author: Stock Piper

Gentrack's H1'24 financial performance and strategic initiatives

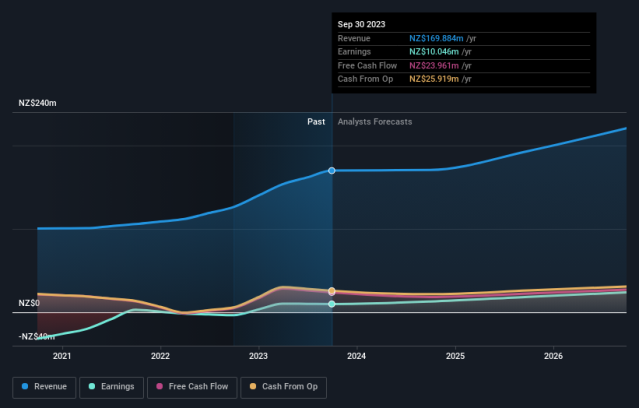

Gentrack Group Limited (ASX: $GTK) has reported a 21% increase in revenue to $102 million for the first half of the financial year 2024. The company's EBITDA of $12.3 million is tracking well against its FY24 guidance. Gentrack's statutory NPAT stood at $5.3 million, reflecting a decrease from $7.9 million in H1'23. The company's cash balance as of 31 March 2024 was $39.3 million, following an investment of $12.9 million in Amber during the period, compared to $41.9 million at H1'23.

Executive commentary on financial performance and strategic outlook

Across the first half of the financial year, Gentrack has delivered strong revenue growth, driven by recent and in-year new customers, as well as upsells and upgrades for existing customers. The company's Utilities segment witnessed growth in all core markets, including New Zealand, Australia, the UK, and the addition of Saudi Arabia as a source of growth. Veovo, Gentrack's airport management software business, experienced a 49.4% increase in revenue, fueled by new customer wins in the UK and the Middle East. Gentrack's strategic investments in R&D and international expansion are aimed at sustaining its growth momentum.

Summary of Gentrack's H1'24 performance and future prospects

Gentrack's H1'24 financial results demonstrate robust revenue growth, particularly in its Utilities and Veovo businesses. The company's strategic focus on new customer acquisitions, product upsells, and international expansion has contributed to its strong performance. Gentrack's decision not to pay an interim dividend reflects its commitment to investing in growth opportunities. The company's investments in innovative solutions, such as the partnership with Amber, indicate its proactive approach to capturing emerging market trends. Looking ahead, Gentrack remains confident in its ability to lead dynamic markets globally and is well-positioned to capitalize on the transformation in the utilities and airports industries.