OFX Group (ASX: $OFX) reveals stable 1H25 performance

- Author: Stock Piper

OFX Group's financial resilience

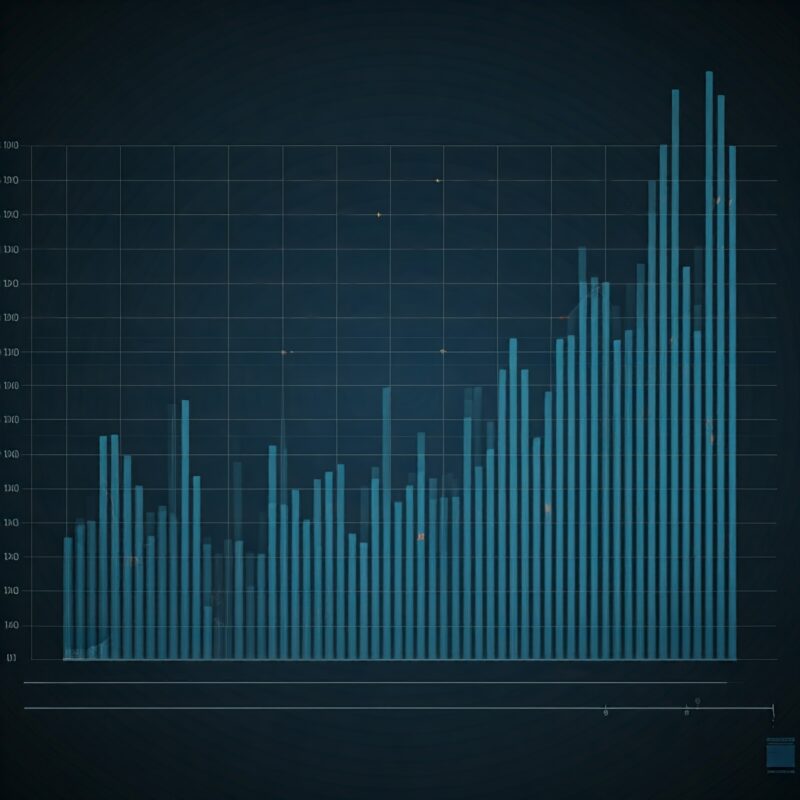

OFX Group (ASX:OFX) reported its financial results for the first half of the fiscal year 2025 on November 12, 2024. Despite facing high inflation and delayed interest rate cuts, OFX maintained a stable performance. Fee and trading income remained unchanged at $114.5 million. Net Operating Income (NOI) decreased by 3.5% to $111.2 million, while operating expenses were reduced by 1.4% to $82.1 million.

OFX Group's strategic direction

OFX Group's financial results for 1H25 highlight its resilience amidst economic challenges. The company achieved stable financial performance with flat fee and trading income and reduced operating expenses. OFX continues to focus on strategic growth by expanding its product offerings and leveraging a new client platform. The company aims for continued growth in non-FX products and plans to scale operations and deploy new products globally in the second half of FY25. OFX remains committed to maintaining a strong balance sheet and pursuing sustainable returns through effective capital management.

Executive insights on 1H25 results

OFX managed to maintain a stable performance despite a challenging macroeconomic environment. Our focus on pricing strategies and cost management has helped us navigate these conditions. We continue to see growth in our corporate and high-value consumer segments, driven by innovations like our new corporate platform.