BHP Group (ASX: BHP) has tabled a bid of $38.8 billion for Anglo American (AAL.L), which could create the biggest copper miner. Anglo American’s shares have rallied by 31% even as BHP is offering shareholders 25.08 pounds ($31.39) per share, which is 31% higher than its current price and gives BHP a significant stake in Anglo American’s iron ore and platinum assets in South Africa where BHP has no activities. This will be the second major acquisition of BHP in a year after the 2023 purchase of Oz Minerals, a copper miner.

Anglo-American owns a series of mines in Chile, South Africa, Brazil, and Australia. If a firm offer goes ahead by May 22, this could create a copper mining giant with 10% of global output. This could set the pace for a range of mergers and acquisitions for metals that are deemed important in the global energy transition. Anglo is currently valued at $37.7 billion and it began a review of its assets in February after a 94% fall in annual profits and a series of writedowns driven by a drop in demand for metals in 2023. BHP is well-known for mining iron ore, copper, coking coal, potash, and nickel, with a market capitalisation of $149 billion.

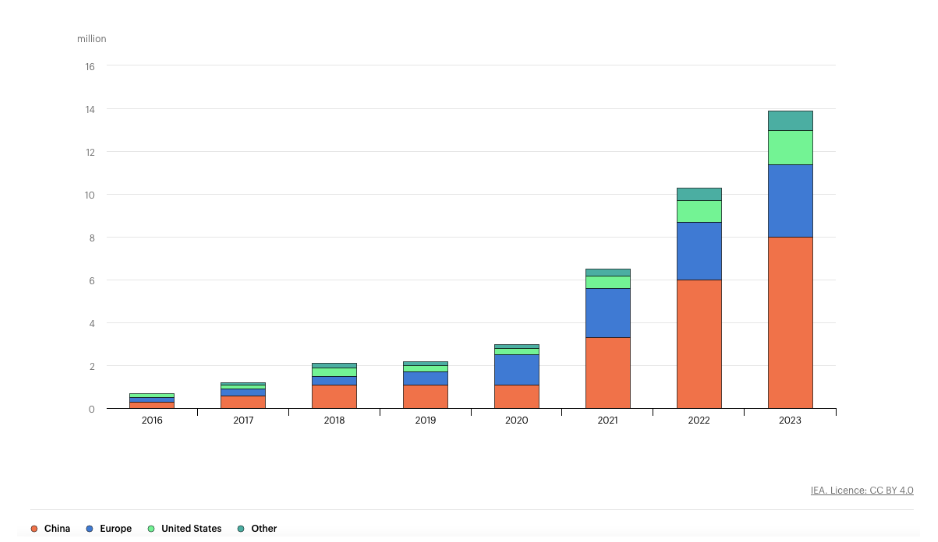

This deal will enable BHP to gain more access to copper and other metals that are vital for the energy transition as well as potash and coking coal which is considered a strategic commodity in Australia. Copper cables and their use in conducting electricity will reinforce demand for artificial intelligence, automation, and the energy transition driven by electric vehicles and renewable energy plants. Furthermore, Anglo has copper mines in Chile and Peru, where BHP operates and their combined output is estimated at 2.6 million metric tons per year, well ahead of U.S.-based giant Freeport-McMoRan (FCX.N) and Chilean state miner Codelco.

Copper’s Run Continues

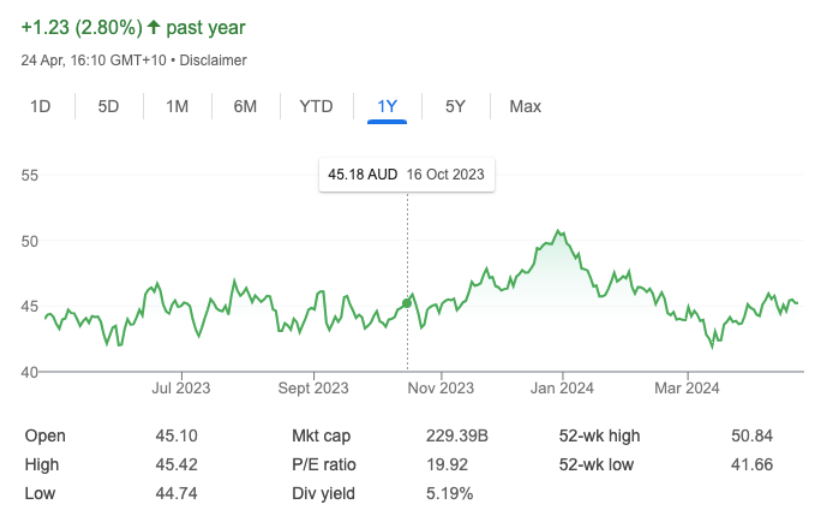

Copper prices have surged by 15% this year on the London Metal Exchange and macroeconomic data and the WTO outlook and forecast suggest demand will spike. Supply chain bottlenecks and the shutdown of the largest mine in Chile signify a continued rally. Anglo forecast its 2024 copper production at 730,000 to 790,000 tons while BHP is targeting copper production of between 1.7 million and 1.9 million tons. Should copper demand rise in line with forecasts, BHP will be serving a larger share of the market and enjoying more substantial gains. BHP's share price has risen by 2.8% in the last year and is currently trading at $45.20. This deal could support euphoria and a feeling of further upside for BHP’s share price over the medium term.

Carve-Outs

Anglo will first need to distribute its entire stakes in Anglo American Platinum (AMSJ.J) as Anglo's stakes in the platinum and iron ore miners are estimated at $7.44 billion and $5.4 billion respectively. Anglo equally has high-quality operations in diamond and this would undergo strategic review after the deal is completed as Anglo owns 85% of diamond giant De Beers. Meanwhile, the coking coal assets of both miners could come under some regulatory scrutiny as they will form the biggest producers across the world.

Finally, EV demand is increasing, albeit at a slower pace than between 2018 - 2021. As countries focus on energy infrastructure, demand for metals rises, supporting mining shares. BHP’s market leadership will equally extend to its Xplore program where six companies have been selected due to their innovation, technical capacity, and projects with good potential. Companies like Cobre Limited (ASX: CBE) that operate tenements in Africa’s top mining jurisdiction will benefit from technical know-how and equally benefit from participating in the accelerator program. Other companies that were selected include Longreach Mineral, East Star Resources, Pallas Resources, Hamelin Gold, and Equivest Minerals.

BHP’s offer of $38.8 billion for Anglo American (AAL.L) will create the biggest copper miner in the world with a 10% market share. Should the deal proceed, BHP and its sphere of influence will see better share price performance and become important actors in major mining jurisdictions.

Author

-

Mark Davidson is an experienced investment analyst and fund manager with a keen eye for identifying market trends. With a strong background in financial services, Mark has contributed to several successful investment ventures over his career. He holds a degree in Economics and has a passion for helping businesses grow and thrive.

View all posts