Although copper prices have risen and supply constraints threaten to reduce global output over the medium term, there are other trends to watch to identify the extent to which the current rally will be sustained over the long run. The declaration from COP 28 suggests that over 80% of the world has agreed to phase out fossil fuels in the coming years and transition to renewable and sustainable energy.

Copper prices have rallied close to $9,000/t and mining stocks such as BHP Group Limited (ASX: BHP) and Cobre Limited (ASX: CBE) rallied and are poised to perform well in 2024 due to strong metal demand and supply constraints. While the closure of the Chilean mine is a cause for concern, rising demand in renewable energy projects and green bonds suggests that copper prices and mining stocks will enjoy fresh highs over the long run.

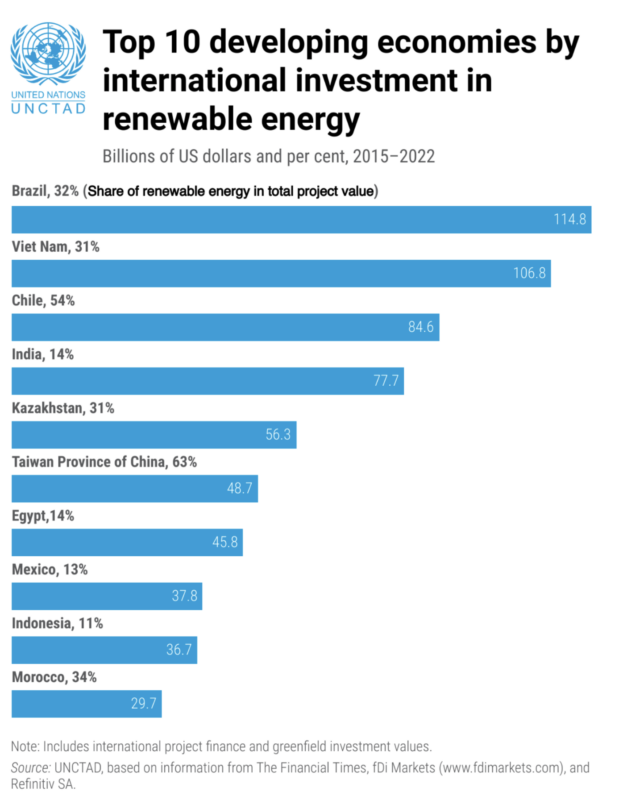

Global FDI declined by 12% in 2022 to $1.3 trillion after a robust gain in 2021 due to the war in Ukraine, rising food and energy costs, and spiralling public debt. Meanwhile, most developed economies saw FDI drop by 37% to $378 billion. However, investment flows to developing nations increased by 4%, with the majority of the investment going to a small number of major emerging nations while the least developed nations saw a drop (Figure 1). Even so, demand for metals is rising and will boost the share price and potential revenue for companies like Cobre (ASX: CBE) and Narryer Metals (70%).

High Growth, Strong Investment, More Demand for Copper

While developing nations pay up to seven times higher than industrialised markets to access capital (IEA, 2021b), there has been a move away from fossil fuel projects towards renewable ones. In its 2023 Investment Report, The United Nations Conference on Trade and Development finds that the ability of foreign investors to access cheaper financing may play a significant role in quickening the energy transition, especially in countries where costs are relatively higher.

While demand for EVs and renewable energy continue to support demand in advanced economies, 10% more renewable energy projects were financed in developing market economies, bringing the number to 1,549 projects. Nonetheless, the total contract value decreased to $665 billion, a 14% decrease. With 855 deals, or more than half of all deals, renewable energy was still the most significant business as it was in 2021. However, contract values are rising in emerging markets (Figure 1), which will ultimately support demand for copper and related minerals.

Renewable Energy Projects on the Rise

Furthermore, installations for Renewable energy generation rose from 8% between 2021 - 2022 to 21% between 2015 - 2022. Demand for copper and critical minerals are not only driven by EV demand, but solar plants, wind turbines and storage units. This shows that the energy transition will accelerate further across Africa and local explorers will anchor supply chains, supporting revenue growth over the long run.

New announcements of greenfield investment projects increased by 15% in 2022 and International investment in wind and solar power increased by 8%. Notably, announced initiatives for the production of batteries increased threefold to exceed $100 billion by 2022.

Copper Prices Have Rallied

This is good for metal stocks and many ASX listed stocks have performed well in March 2024 including Many Peaks Minerals (119%), Narryer Metals (70%), Pantoro (61%) and Reach Resources rose 64%. Meanwhile the share price of Cbre has equally packed up over the last year and last six months, rising by 41% and 40%. UNCTAD's global Investment report shows that investment in renewable energy is rising - highest in advanced economies - while investment in battery and storage technologies are also on the rise. Demand for copper will persist over the long run and metals stocks will continue to rally. While Big names like BHP and Anglo American will rally, African explorers like Cobre will see a boost in their share price and revenues as renewable energy supply chains move closer to reduce both cost and risk for projects that are lodged in Africa.

Author

-

Mark Davidson is an experienced investment analyst and fund manager with a keen eye for identifying market trends. With a strong background in financial services, Mark has contributed to several successful investment ventures over his career. He holds a degree in Economics and has a passion for helping businesses grow and thrive.

View all posts