The recent surge in prices for the raw materials that power manufacturing and transportation shows investors are increasingly betting on a prolonged expansion and a potential rebound in inflation. An index comprising global commodities prices - the S&P GSCI - rose by 11% in 2024, outpacing the S&P 500’s 9.2% climb. As other commodities have recovered, Copper has equally seen its price rise significantly, gaining over 10%, while gold posted fresh highs of 14% to $2,343 a troy ounce.

In the first week of April, copper rose 1.5% to $9000 a ton on the London Metal Stock exchange, while aluminum jumped 2.2% hitting $2,387, the highest level since January even as Zinc rallied 1.8% as all metals except lead rose. When copper prices rise, the share price of explorers - especially mid to large caps - tends to outperform. As such, the rally will lift plenty of boats, allowing firms like Cobre Limited (ASX: CBE) with strong prospects in Botswana, Africa to enjoy a favorable global environment.

What is driving the rally?

The Purchasing Managers’ Index in China registered a positive outcome in March 2024, the highest reading in a year. This is equally reinforced by recent data on strong exports and rising consumer prices, suggesting that China may be escaping its disinflationary and slow growth. Investors are equally more optimistic about China’s prospects after the March PMI reading in a year, which is supporting market sentiment and trend consumption. This is good news for ASX stocks like Cobre Limited (ASX: CBE), especially as supply-side constraints in Chile appear more entrenched with labor strikes and mine closures impacting global supply for copper.

Global companies benefitting from Copper Rally.

Major global mining stocks have seen a spike in their prices associated with the rally in copper prices. For example, In Australia, Rio Tinto Ltd (ASX: RIO) and BHP Group Ltd (ASX: BHP), surged by over 2% each while U.S.-listed Freeport-McMoran (NYSE: FCX) climbed 7.6%. Even the shares of Swiss commodity trader Glencore PLC (LON: GLEN) hit 5% higher on the news of higher copper prices.

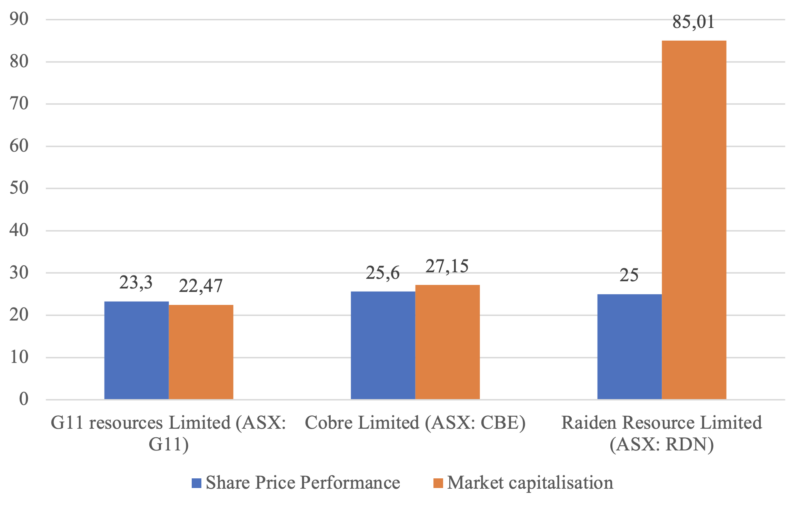

If one takes a closer look at mining-related stocks listed in the ASX, their shares have equally rallied. For example, Cobre Limited (ASX: CBE), Raiden Resource Limited (ASX: RDN), and G11 resources (ASX: G11) have risen by 25.6%, 25%, and 23.3%. Meanwhile, stocks with a similar market capitalisation such as Metallica Lineral Limited (ASX: MLM) have risen 23.03% over the last three months (see chart below). So the rally in copper prices has supported price action, even as other fundamental factors are equally supporting share price performance.

Source: Australian Securities Exchange

A bit of Cobre History is necessary to understand the current rally

On July 17, 2022, Cobre Limited (ASX: CBE) regained its 200-day simple moving average and closed at 0.086. after it formed a green candle at 0.215 on August 1, 2022. Then, novice traders faced stop-loss hunting that flushed them out, after which the stock reached a high of 0.730 on August 22, 2022.

Cobre is poised to Benefit from Copper Rally

It seems poised to repeat this pattern. It recently reached a high of 0.097 and regained its 200-day simple moving average, flushing out short-tempered traders and investors in the following days as it dipped below the 200-daily moving average again (See chart below). Now, it has convincingly regained its 200 daily moving average and appears likely to retest its high of 0.730. If this occurs, it could potentially yield at least a 10 fold return.

Positive Short-term Forecast for Cobre Limited (ASX: CBE)

- Cobre Limited (ASX: CBE) has finally convincingly broken out of its falling trendline resistance. The most immediate target could yield a 250% return, followed by a potential 1000% return in the long run. Cobre has now moved above the upper Bollinger Band with a strong green candle. It appears set to potentially deliver a similar return to what it achieved in 2022.

- Cobre Limited (ASX: CBE) is trading above all its moving averages, namely the 20, 50, 100, and 200-day averages. It is now ripe for a potential 500% return in the short term. The strong trend in copper also supports this potential move.

- Cobre Limited (ASX: CBE) has convincingly broken out of its parallel channel, and the RSI is projecting a very strong trend moving forward. The copper price will likely contribute significantly to its upward movement.

Cobre in Botswana and the need to target companies with global exposure

Most of the companies who benefited from the ASX-linked copper rally have projects based in Australia, except BHP and Rio Tinto which have a global presence. However, it is important to look closely at companies like Cobre Limited (ASX: CBE) which are operating in Africa’s top mining jurisdiction and the seventh-best mining destination in the world. In addition to advanced and environmentally friendly in-situ methods, its projects have the potential to deliver a range of minerals that are indispensable to power the energy transition. It equally owns 100% of its tenements and projects, shielding investor return over the long run.

Copper prices have rallied on the back of a recovering Chinese economy and shortages that are continuing to plague mines in Chile. The share prices of mining companies have responded positively, however, ASX-listed stocks like Cobre have more room to go and it appears the stock could be staging the next major comeback. There are plenty of good potential stocks, but Cobre stands out with its high-quality projects, skilled steam, and location in a top global mining jurisdiction.