IPH (ASX: $IPH) is a downtrodden growth stock but after the Canadian acquisition of B&P it will be the largest player in Canada and in a really strong market position to bring earnings growth.

Intellectual property may not be the flashiest industry, but IPH has been making steady moves behind the scenes, strategically constructing an IP empire that spans important developed markets.

IPH can be thought of as a stable, cash-generating business with solid organic EPS growth and a ~7% dividend yield.

With a steady stream of acquisitions and a growing presence in emerging sectors like AI and silicon chips, IPH is positioning itself as a global heavyweight in trademarks and patents outside of the US.

Despite underperforming against the broader ASX market, the company’s long-term prospects remain solid, offering stable, cash-generating growth for investors. Here’s why IPH’s valuation is compelling and a focus on organic growth with it’s Canadian acquisition shouldn’t be overlooked.

The Acquisition: IPH Expands into Canada

In a move that solidified its dominance, IPH recently acquired Canadian firm Bereskin & Parr (B&P), extending its market reach beyond Australia and New Zealand into North America. This acquisition is not just another notch in IPH’s belt but a strategic decision that positions the company as the largest player in trademarks across three significant markets: Australia, New Zealand, and now Canada.

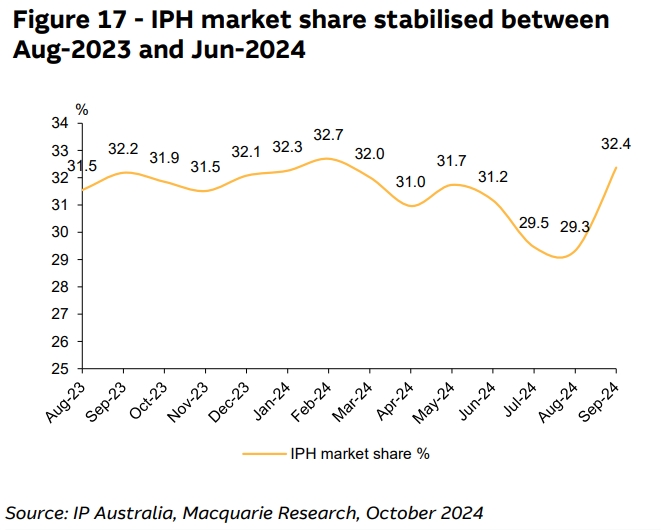

Canadian market share reaches ~35%, roughly level reached in Australia and New Zealand to be the market leaders now in 3 countries. This was funded with a equity raising and that notionally reduced debt levels to 1.7x FY24 proforma Net Debt/EBITDA. This in the short term depresses the share price as new equity is adsorbed in the market, it opens the opportunity to pursue more M&A as management has previously flagged.

Figure 1: IPH market share stabilised between Aug 2023 and Jun 2024

Source: IP Australia, Macquarie Research, October 2024

Over the past 18 months, IPH has been focused on integrating these acquisitions, with B&P being the latest piece of the puzzle. The consolidation is expected to lead to significant cost savings and earnings growth in the near future as the company unlocks synergies between its various operations. While critics might raise eyebrows at IPH’s acquisition-driven growth strategy, the integration phase is a necessary step to extract maximum value from these deals, and IPH is poised to benefit from this in the coming years.

AI and Silicon Chip Patents

The rise of artificial intelligence (AI) and silicon chip technology has opened new avenues for companies like IPH to capitalise on patent-related services. As these sectors continue to expand at an exponential rate, the demand for securing intellectual property in these domains will grow alongside them.

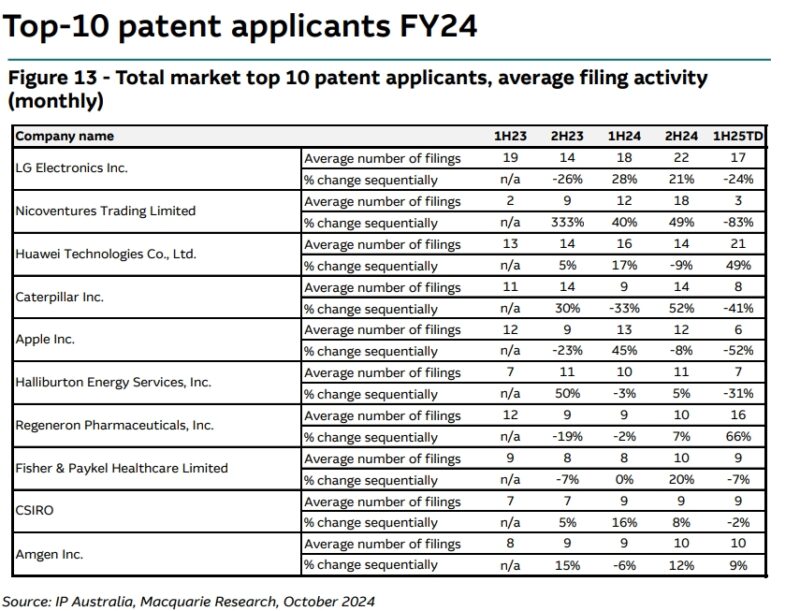

Figure 2 shows the long-term opportunity that IPH is positioned to capitalise on, making the company’s strategy in AI and silicon chip technology.

Figure 2: Total market top 10 patent applicants, average filing activity (monthly)

Source: IP Australia, Macquarie Research, October 2024

IPH is strategically positioning itself to ride this wave by offering specialised IP services to companies in these cutting-edge industries. Whether it's patents for AI algorithms or intellectual property protection for next-gen silicon chips, IPH is well-equipped to cater to the unique needs of these rapidly evolving sectors. With its global footprint and established expertise, IPH stands to become a key player in patenting the future of technology.

Stock Performance: A Disconnect Between Growth and Market Sentiment?

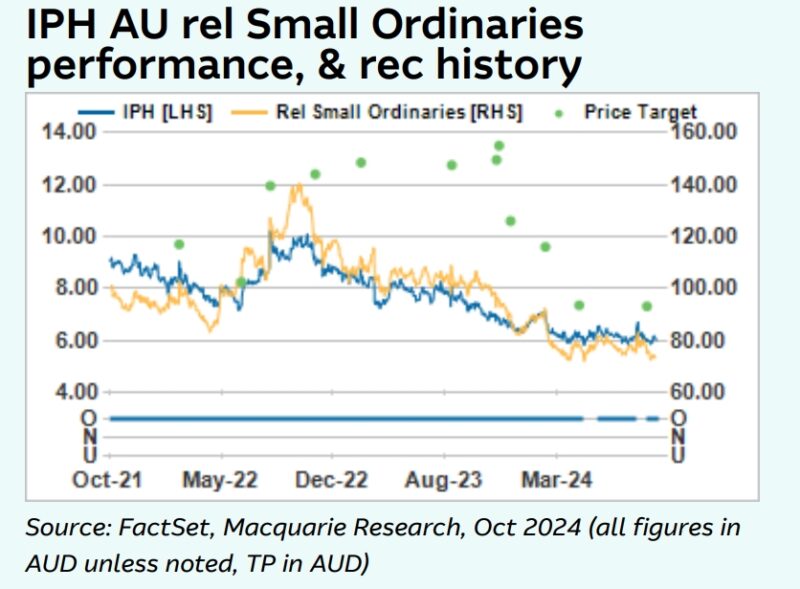

While IPH’s business fundamentals are robust, its stock performance has been less than stellar compared to the broader ASX market. Year-to-date, IPH has underperformed, sparking concerns among investors who remain wary of the company’s acquisition-led growth strategy.

Figure 3: IPH AU rel Small Ordinaries performance. And rec history

Source: FactSet, Macquarie Research,Oct 2024

Market bears argue that the company’s dependence on acquisitions could eventually stall organic growth, a common criticism for firms that expand through mergers and buyouts. But does this narrative hold water?

It’s important to note that while acquisitions have been a significant driver of IPH’s growth, the company’s client base is “sticky,” meaning customers tend to stay with the firm once they’ve signed on. This creates a stable revenue stream, supported by the fact that IPH operates in a niche but essential market. Intellectual property services are not going away anytime soon, and IPH’s strong market position makes it less vulnerable to short-term fluctuations in investor sentiment.

Valuation and Growth: A Compelling Long-Term Opportunity

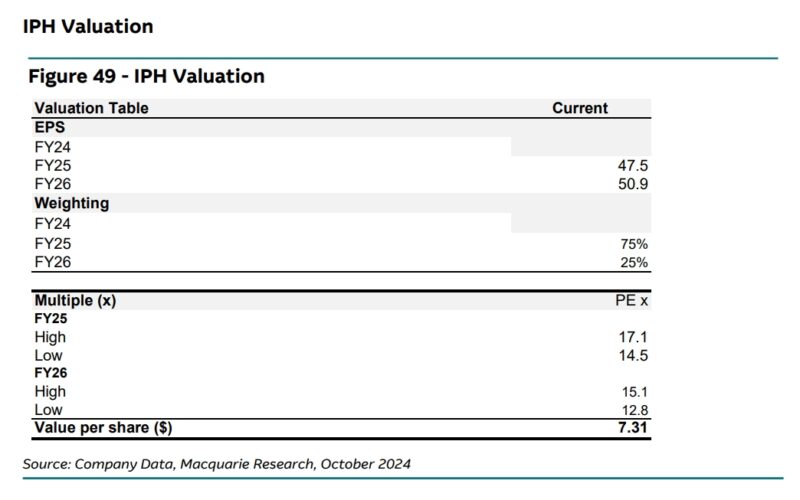

Figure 4: IPH Valuation

Source: Company Data, Macquiarie Research, October 2024

Despite the market's hesitations, IPH presents a compelling case for long-term investors. Currently valued at approximately 11x price-to-earnings (P/E), the company offers a solid dividend yield of around 7%, making it an attractive option for those seeking stable, cash-generating businesses.

What’s more, IPH’s organic earnings per share (EPS) growth rate stands at a steady 7%+, a sign that the company is not just relying on acquisitions to fuel its expansion. This predictability in growth, combined with its healthy dividend, offers a strong value proposition in an otherwise volatile market. For investors willing to look beyond the short-term stock performance, IPH could be a hidden gem in the intellectual property sector.

Is Acquisition-Led Growth a Red Flag?

No company is immune to criticism, and IPH is no exception. Some investors are sceptical of IPH's focus on acquisition-led growth, viewing it as a strategy that may inflate short-term performance at the expense of long-term stability. However, this concern seems overstated given IPH's history of smart acquisitions that enhance its market position and generate value.

Moreover, the integration of B&P and other recent acquisitions demonstrates that IPH is not just acquiring for the sake of growth but rather is pursuing strategic expansion into complementary markets. The company has shown its ability to manage acquisitions effectively, unlocking synergies and realising cost savings along the way. For IPH, acquisitions are not a gamble but a calculated strategy to expand its empire in a disciplined manner.

IPH’s Intellectual Property Empire

As IPH Ltd continues to quietly build its intellectual property empire, investors would do well to pay closer attention. With a strong presence in Australia, New Zealand, and Canada and growing opportunities in emerging sectors like AI and silicon chip technology, the company is positioned for sustainable, long-term growth.

A stable, cash-generating business with solid organic EPS growth and a ~7% dividend yield.

Despite market scepticism, IPH’s steady earnings growth, reliable and growing dividend yield, and smart acquisitions make it a strong player in the intellectual property arena. For investors seeking a stable, cash-generating business with long-term upside, IPH is a stock worth considering with a compelling valuation—even if the broader market hasn’t yet caught on to the empire quietly being built.

Author

-

Martin Rogers is a seasoned ESVCLP fund manager and venture capitalist with decades of experience in investment markets. As an entrepreneur and investor, he is well-versed in deal origination, due diligence, operations management, and financial execution. Mr. Rogers holds degrees in Chemical Engineering and Computer Science. His extensive background includes incubating companies and working with publicly listed organisations. He supports founders in building remarkable businesses and collaborates with them to bring their visions to life.

View all posts