Raiden Resources Limited (ASX: RDN) is a dual-listed mineral exploration and development company that is exploring the Nickel-Copper-Cobalt-Palladium deposit in the Pilbara, located in Mt. School. The company’s portfolio is host to metals and commodities that are considered critical for the energy and electrification revolution. During the year 2023, the main activities of Raiden Resources Limited (ASX: RDN), were mineral exploration in the Pilbara region of Western Australia, on the Andover North-South, Mt Sholl, and Arrow Lithium projects. The company equally holds the right to projects in Europe, where it has established an exploration footprint in Serbia or Bulgaria.

Raiden Resources Assets

The Company holds rights to projects in the Western Tethyan metallogenic belt in Eastern Europe, where it has established an exploration footprint in Serbia and Bulgaria. Raiden Resources Limited (ASX: RDN) is a copper-gold exploration company that is focused on discovering large-scale mineral deposits in the Tethyan region of Eastern Europe. Raiden operates in low-cost mining jurisdictions and systematically applies modern techniques in its range of Tier 1 projects.

Raiden’s current portfolios are composed of tenements in Serbia, which are either managed as a portfolio of tenements in Serbia that are managed via joint ventures or earn-ins with Rio Tinto. Raiden Resources Limited (ASX: RDN) has an established network across the region, thereby leveraging a first-mover advantage and it continues to review a pipeline of new projects in the region.

Raiden Resources Flagship Project

Arrow Project

The company has begun a reconnaissance mapping exercise on this project and recent results from the project indicate potential mineralisation from samples of soil (pegmatites) that were reviewed and tested by the fluorescence test of samples under Ultraviolet (“UV”) light.

In 2023, the Company also submitted the soil samples, previously collected during the gold exploration program and the results are being evaluated for lithium and associated element analysis.

Tabba Tabba

The Company undertook a review and compilation of historical exploration and geophysical data on the project in 2023. Based on preliminary analysis, management has defined probable potential lithium-bearing pegmatite. In its October 2023 company report, the presence of available magnetic data sets indicate the presence of lithium-bearing mineralisation, however, ultrafine soil sampling could further assist in identifying potential mining targets.

Vuzel

Through its 51% owned Bulgarian subsidiary, Vuzel Minerals Ltd, successfully extended the exploration period of the project for a further two years. The management team is planning for the drill campaign to be undertaken in 2024 to follow up on the high-grade targets.

Zlatusha

Throughout the reporting period, target-research work has been undertaken by Velocity Minerals as agreed in the option agreement, announced on 24 January 2023. As part of the exploration program, Velocity has already spent a total of $516,572 and executed a drone magnetic survey pn 2,400km, a 4,500-station ground radiometric survey, and the collection and analysis of 1,800 soil samples.

Furthermore, detailed mapping targets under the agreement are being executed by both parties with an option to earn 75% interest through sole funding and the completion of a preliminary Economic Assessment (EPA) for a maximum of 40,000 meters of exploration drilling and a cash/stock payment of C$1m to Raiden over the term of the agreement. To date, Velocity has made the first stage payment of C$220k to Raiden in the form of Velocity stock and has also undertaken the maintenance of all Zlatusha project work programs and environmental bank guarantees.

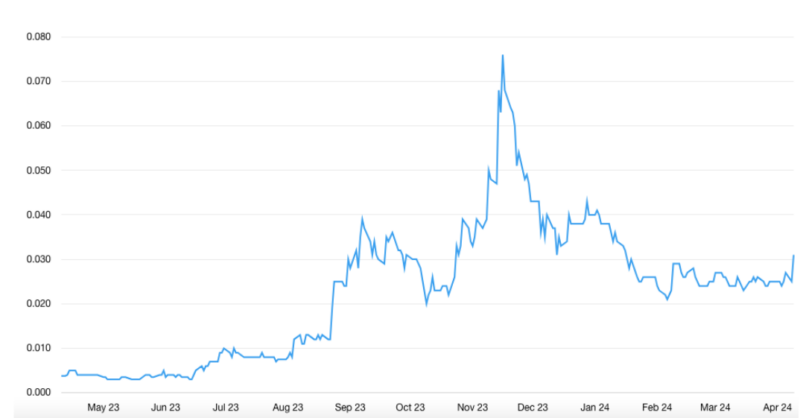

Raiden Resources Share Price Performance

Raiden Resources share price has performed well in the last six months. The strong performance in the share price has been driven by a mix of external factors such as copper demand and prices and strong fundamental factors. However, short-run price dynamics are noisy and driven by a range of factors such as Chinese demand, the level of interest rates, or spikes in geopolitical uncertainty. Notably, the share price for Raiden Resources Ltd (ASX: RDN) has risen by 60% in the last 6 months to AUD 0.032. With copper demand and copper prices rising, the correlation with copper stocks suggests that there is further upside for both stocks.

If one looks at the fundamentals of the company, the company has engaged in prospective drilling that has strong potential, however, it is making a loss at present. The comprehensive loss for the half year 2023 fell to AUD 2,029,883 in 2024 from AUD 5,199,588. However, the company Raiden Resources Limited (ASX: RDN) is showing a range of projects that have strong potential and can support medium-term revenue.

Raiden Resources Ltd (ASX: RDN) is a mining company with strong mining potential, whose share price has performed better over the last six months in comparison to a year ago. The company presents a range of projects with good potential for mineral exploration in addition to a range of partnerships that have enabled it to begin investigating the potential for drilling across several sites. The company’s projects are located in Serbia and Bulgaria with good transport networks that facilitate the transportation and sale of eventual minerals. Raiden Resources Limited (ASX: RDN) is showing a range of projects that have strong potential and can support medium-term revenue and long-term shareholder value creation.

Author

-

Mark Davidson is an experienced investment analyst and fund manager with a keen eye for identifying market trends. With a strong background in financial services, Mark has contributed to several successful investment ventures over his career. He holds a degree in Economics and has a passion for helping businesses grow and thrive.

View all posts