The finance sector is full of hidden gems that are just waiting for someone with a keen sense of value to discover them. For value investors, the current market climate presents exciting possibilities, and Oncosil Medical (ASX: $OSL) stands out as a particularly compelling opportunity. This article delves into the reasons why $OSL, with its current undervaluation and promising future potential, might be an ideal candidate for value investors seeking long-term growth.

OncoSil's Undervalued Proposition

Finding investments that are undervalued despite having the potential for large future gains is the foundation of value investing. Oncosil presents a compelling case for such an asset, currently boasting a low market capitalisation of approximately AUD $14.22 million. This figure, when compared to its peers and potential future prospects, suggests a significant undervaluation. This translates to an opportunity for investors to acquire shares at a potentially steep discount to their future worth. Value investors can profit from significant growth by making an investment in $OSL now, as the market begins to recognise the company's true worth.

Recognising Accumulation: Clues Pointing to OncoSil's Potential

Beyond the enticing aspect of OncoSil's current undervalued state, a closer look at its technical analysis reveals encouraging signs of accumulation, suggesting potential for future growth. This accumulation phase is characterised by several key technical indicators:

Green Bars Dominating Volume Charts: Delving into Oncosil's 40-week candles reveals a compelling narrative of accumulation. Over this period, the stock has witnessed 28 green bars, indicating consistent buying interest and potential accumulation by smart investors. What's particularly striking is the prevalence of ‘pinbar’ formations across most bars, accompanied by substantial volumes, signalling robust investor participation and confidence in OncoSil's long-term prospects.

This accumulation phase suggests that OSL may be on the brink of a significant upward move, as pent-up buying pressure could translate into substantial gains. Investors eyeing lucrative opportunities in the market may find OSL particularly appealing, given its apparent accumulation pattern and the potential for a bullish breakout in the near future.

Technical indicators in Harmony: Technical indicators like the 50-day EMA staying above the stock price and the RSI rebounding from oversold levels further support the notion of accumulation. These indicators, combined with the green bar dominance, suggest a potential shift in sentiment towards the stock, with investors accumulating shares in anticipation of future value appreciation.

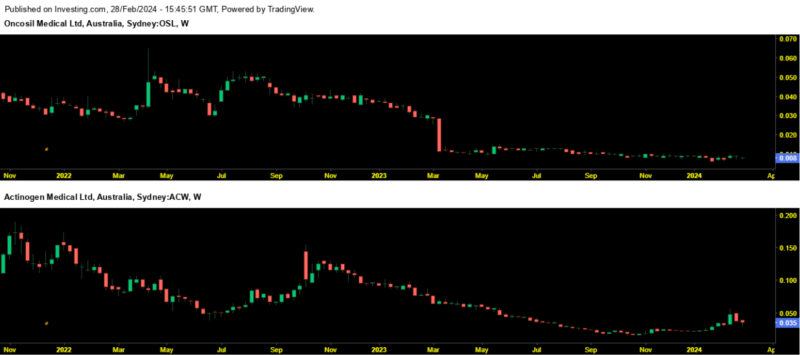

Comparison with Industry Leaders: Interestingly, we find a notable resemblance between the past five years' performance of OSL and well-known biotech companies such as Actinogen (ASX: $ACW) and Cochlear (ASX: $COH).

These successful companies also exhibited a similar accumulation phase before experiencing significant growth in their stock prices. This historical parallel adds another layer of support to the notion that $OSL's current accumulation phase could be a precursor to similar future growth.

Comparison Chart: $OSL and $ACW

Examining Return Comparison Data to Uncover $OSL's Long-Term Growth Prospects

To further solidify the case for $OSL's potential as a valuable long-term investment, a comparison of its historical returns with established players in the biotech sector is insightful. Analysing the five-year return comparison of $OSL against Actinogen ($ACW), Cochlear ($COH), and $CSL reveals $OSL's potential for outsized gains over an extended period.

It is important to acknowledge that each company within this comparison operates with its own unique set of opportunities and challenges. However, focusing specifically on $OSL, its upward trajectory, and the ongoing accumulation phase suggest a favourable position for long-term investors seeking significant returns within the biotech sector. While past performance doesn't guarantee future results, the comparison with established companies with similar historical trends offers valuable context for understanding $OSL's potential for substantial growth in the years to come.

A Value Investor's Opportunity with Long-Term Potential

Oncosil (ASX: $OSL) presents a unique confluence of factors that make it a compelling proposition for value investors seeking long-term growth. Its undervalued state, coupled with technical indicators pointing towards accumulation and historical comparisons suggesting similar trajectories for successful companies, paints a promising picture for the future.

While past performance is not indicative of future results, the potential for outsized gains compared to established peers within the biotech sector further strengthens the case for OncoSil. As the company progresses through its clinical trials and establishes itself within the healthcare landscape, investors who capitalise on this opportunity during the accumulation phase have the potential to benefit from significant long-term growth.

Author

-

James Turner is a skilled economist and fund manager with extensive experience in the investment sector. Known for his strategic thinking and analytical skills, James has played a key role in the success of many investment portfolios. In addition to his financial work, he writes about market trends and shares his insights through various publications.

View all posts